The National Association of Insurance Carriers (NAIC) has adopted a new life insurance valuation manual. LifeHealthpro has a good overview. It has not been implemented yet, not by a long shot. The process has similarities to amending the US constitution where a percentage of states have to ratify the changes, but in addition the state’s size matters. 42 states and 75% of written life premium in the United States are needed for it to be instituted. Since New York and California have objected, and their share of written premium is a sizable, the outcome of this is still in considerable doubt. What is revealing are some of those objections. From the LifeHealthpro (emphasis mine):

Critics said passing it would be a failure of state regulation, with New York’s Deputy Insurance Superintendent and General Counsel Robert H. Easton arguing that PBR will lead to lower reserves “in the aggregate” at a time when the economy is still fragile, when interest rates are low for the foreseeable future and, most interestingly, when Easton said some carriers are “facing stress” because of guarantees currently on their books. Easton did not elaborate on who those companies are and how stressed they may indeed be.

Critics and some concerned state regulators also raised the state resource issue for implementing and understanding the new models with all the training necessary, most explicitly described by California Insurance Commissioner Dave Jones.

“There is no fiscal analysis now. We have no idea what this will cost,” Jones said. “It requires a different skill set to look at these black boxes,” said Jones, who discussed all the unknown and known resources and expertise needed at the state level.

From the Wall Street Journal:

Benjamin Lawsky, superintendent of the New York Department of Financial Services, had urged fellow regulators to vote no in a letter dispatched last week.

“The insurance industry weathered the financial crisis well precisely because of the careful reserving state regulators have historically required,” Mr. Lawsky said Sunday. “To ignore the lessons of the financial crisis and deregulate the industry, allowing them to keep less in reserves, is unwise.”

The jury as to the merits of the change is still out in my mind. To be objective requires an in depth evaluation of the proponents reasoning for the change as well as the validity of the objections, but I tend to be skeptical given what happened to AIG and the causes of The Great Recession.

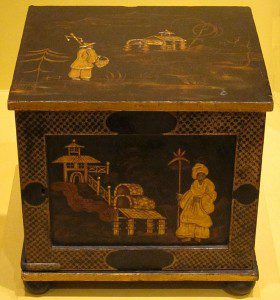

image source: Wikimedia Commons